How to Opt-Out of CoreLogic

How to Opt Out

Learn how to remove your records.

View More Guides

Learn how to remove information from data brokers.

Remove Information For Me

Sign up for online privacy protection.

CoreLogic is a major provider of real estate, financial, and consumer data. It collects information on property records, credit data, and personal details. If you value privacy, you may want to opt out.

In this guide, we’ll show you how to remove your data from CoreLogic step by step. We’ll also explain why this matters and how it protects you.

What is CoreLogic?

CoreLogic is a leading data analytics company that specializes in property information, business-to-business services, and data-driven solutions. It collects, analyzes, and sells real estate data to businesses, helping industries like mortgage lending, insurance, and market research make informed decisions. As a merged credit report provider, CoreLogic also plays a role in credit consumer reporting, offering insights that lenders use to assess risk.

As one of the largest data brokers, CoreLogic compiles property records, home values, and mortgage details into a real estate solutions database. Companies rely on this information for fraud detection, risk management, and investment decisions. However, the company has faced privacy concerns over how it collects and shares personal data. Despite this, CoreLogic remains a key player in the mortgage industry, helping businesses streamline processes and reduce financial risk through analytics and market research.

Data Collection by CoreLogic

CoreLogic gathers data from various sources to provide insights for real estate, financial services, and insurance industries. The company collects information from public records, property records, and real estate transactions, helping businesses make informed decisions. It also uses consumer credit data, rental history, and financial information to assess market trends and risk factors.

As a data broker, CoreLogic aggregates details from third-party sources, combining them with its proprietary data to offer accurate reports. This includes personal information (PII) such as names, addresses, and transaction history. Their data collection policies ensure compliance with industry regulations while leveraging market-related data to support lending, insurance, and property valuation services.

Understanding how companies like CoreLogic collect and use information is important for consumers. Whether through data aggregation or direct collection, their insights influence everything from home appraisals to credit risk assessments.

How to Opt-Out of CoreLogic and Remove Your Info

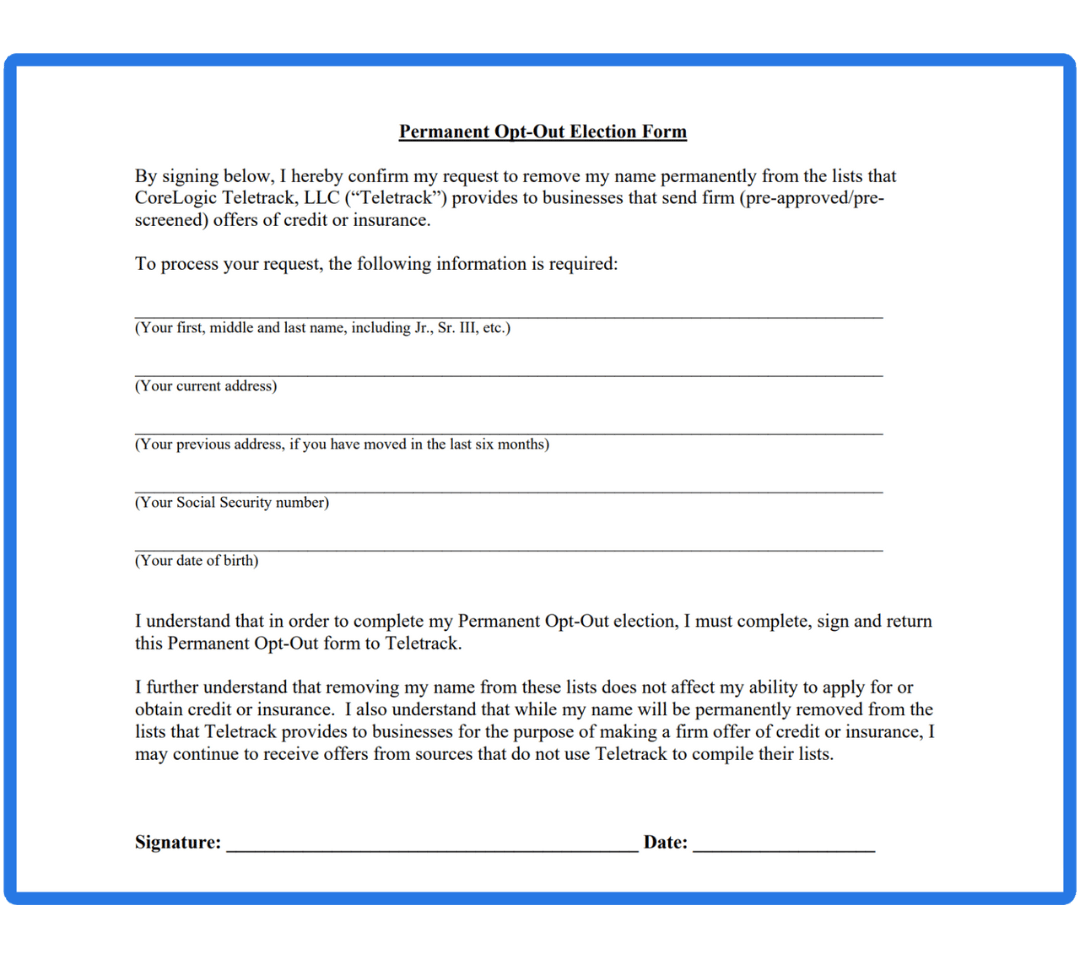

- Download and Print the CoreLogic Opt-Out Form: To initiate the opt-out process, start by downloading and printing the CoreLogic opt-out form. This form allows you to request the removal of your personal information from CoreLogic's databases. https://www.corelogic.com/downloadable-docs/teletrack-out-opt-form.pdf

- Complete the Form: Fill in the required fields on the opt-out form, including your first, middle, and last name, current address, previous address (if you've moved within the past six months), and date of birth. Sign and date the form to confirm your request.

- Mail the Completed Form: Once you have completed the form, mail it to CoreLogic Teletrack using the address provided on the form. This step ensures that your request reaches the appropriate department for processing.

Alternative Opt-Out Methods

If you want to remove your information from CoreLogic but don’t want to go through their standard opt-out process, there are other options. Most people use third-party services like NewReputation or another automated data removal service to handle the process for them. These services submit requests on your behalf and monitor for future data collection.

Another method is to send a written request via physical mail to CoreLogic USA, ensuring your opt-out is processed manually. If you prefer a direct approach, you can contact them through their toll-free number or CoreLogic Solutions and eTech email to request removal. Some users opt for a temporary opt-out, which removes data for a limited time, while others complete qualifying forms for a permanent opt-out.

CoreLogic Teletrack

Opt-Out Request

P.O. Box 509124

San Diego, CA 92150

Include a statement requesting permanent removal from CoreLogic Teletrack's prescreen lists. You can use a condensed version of the statement found on CoreLogic's opt-out form.

If you’re struggling with the process, automated tools and services simplify it by filling out the opt-out form and submitting it for you. Whatever method you choose, following up and confirming that your request has been processed successfully is important.:

Opt-Out Duration and Confirmation

The opt-out process helps individuals remove their personal information from data brokers. The opt-out request processing time varies, depending on the company and method used. Some requests are processed instantly, while others take a few days or weeks. Automated opt-out requests typically move faster than manual submissions, but delays can occur if additional personal information requirements need verification.

Once an opt-out request is submitted, users should track their status through the company’s tracking removal requests system. Many data brokers provide an opt-out confirmation email or an online portal where users can check progress. If confirmation isn’t received within the expected opt-out process duration, individuals may need to follow up or resubmit their request.

Certain companies offer a temporary opt-out period, meaning personal data might reappear after a set timeframe. To maintain privacy, users should regularly monitor their opt-out status and be aware of opt-out eligibility requirements. Ensuring a smooth data removal process requires patience and persistence, as each company follows different verification procedures. Regular privacy maintenance helps prevent personal data from resurfacing.

Frequently Asked Questions (FAQs):

- Where do I mail the CoreLogic opt-out form? Mail the completed opt-out form to the address specified on the form itself. Follow the instructions carefully to ensure your request reaches the appropriate department for processing.

- How do I freeze my CoreLogic credit report? CoreLogic does not provide the option to freeze your credit report directly. To freeze your credit, you must contact other credit bureaus (Equifax, Experian, and TransUnion) and follow their specific procedures for credit report freezes.

- What does freezing CoreLogic do? Freezing CoreLogic does not directly freeze your credit report. However, by opting out of CoreLogic, you can prevent them from utilizing your personal information for marketing purposes and limit its accessibility to third parties.

Protecting Your Personal Information with NewReputation

If you're looking for comprehensive protection of your personal information beyond just opting out of CoreLogic, NewReputation is here to help. We specialize in removing personal information from over 180 sources across the web, ensuring your data remains safe and secure. Contact NewReputation today to take control of your online privacy and safeguard your personal information from public exposure.

Take Control of Your Privacy

Opting out of CoreLogic is an important step in safeguarding your personal information. By following the outlined process, you can request the removal of your data from their databases. Additionally, comprehensive solutions like NewReputation can provide extra protection for your privacy. Remember, remaining proactive and vigilant when safeguarding your personal information in today's digital age is essential.

Data Broker Opt-Out Guides

- CallTruth.com Opt-Out

- Casetext.com Opt-Out

- Centeda.com Opt-Out

- Checkpeople.com Opt-Out

- Checksecrets.com Opt-Out

- City-data.com Opt-Out

- ClickSearch US Opt-Out

- Clustrmaps.com Opt-Out

- CocoFinder.com Opt-Out

- Confidentialphonelookup.com Opt-Out

- Corelogics Opt-Out

- CorporationWiki Opt-Out

- Councilon.com Opt-Out

- Courtcasefinder.com Opt-Out